statute of limitations colorado debt

Check to see the limitations period in your state and if the debt had gone into default longer ago than the statute of limitations period you may be able to defeat that lawsuit. There are few exemptions for account levy in Colorado.

Colorado Statute Of Limitations Drug Crime Debt Lawsuits

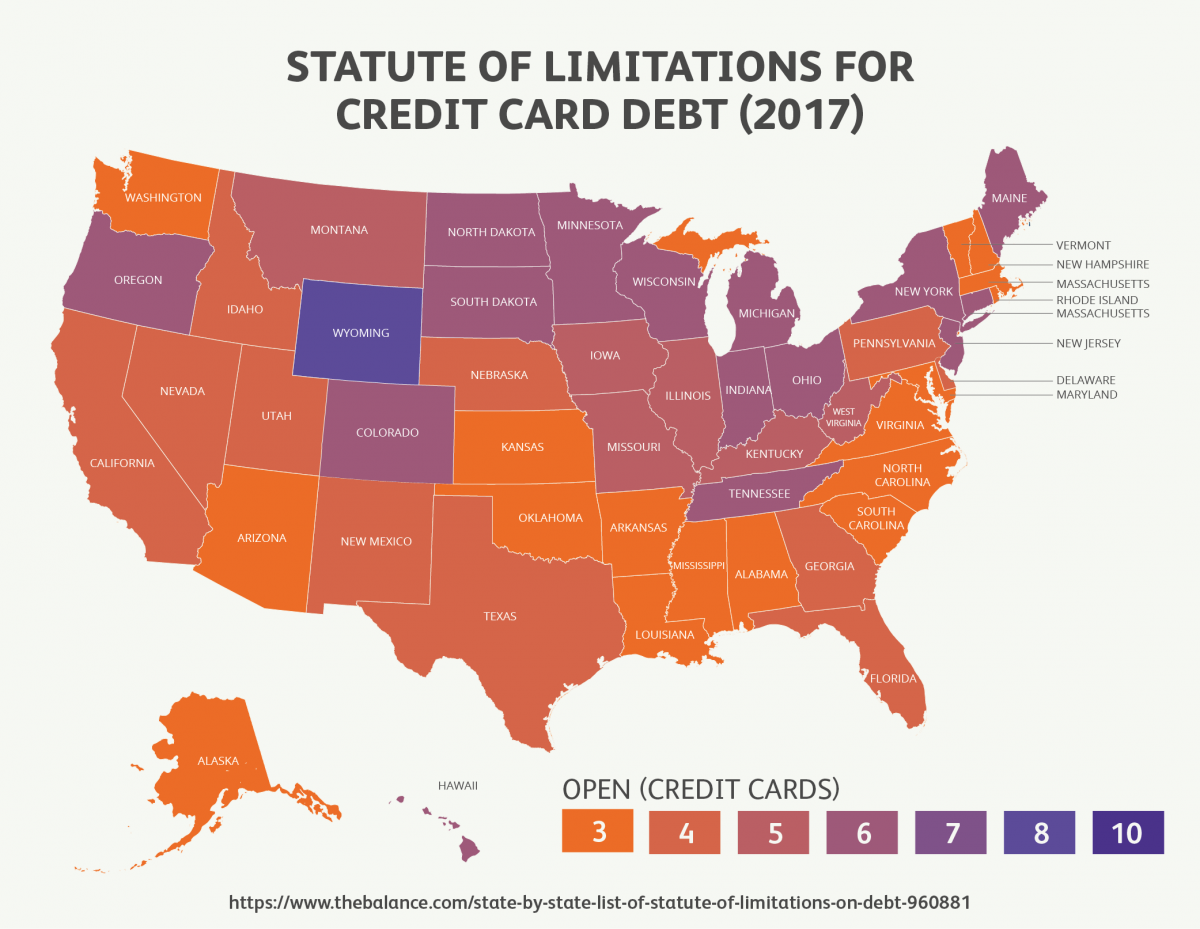

5 rows The statute of limitations is the time within which a debt collector can sue you for unpaid.

. The table below shows the statute of limitations per state depending on the. My understanding is that the statute of limitations in CO for medical debt is 6 years - which is coming up in less than 3 months. Colorado Debt Statute of Limitations ors perhaps the government that is federal third-party agencies may be pretty persistent.

What is the statute of limitation for breach of contract in Colorado. Three years except when its six T. Conventional wisdom has been that collection actions had to be brought by lenders within six years from the date the loan first went into default.

This is because Colorados statute of limitations on debt is six years. Medical debt is considered a written contract. Each state places limits on how long creditors can pursue debt.

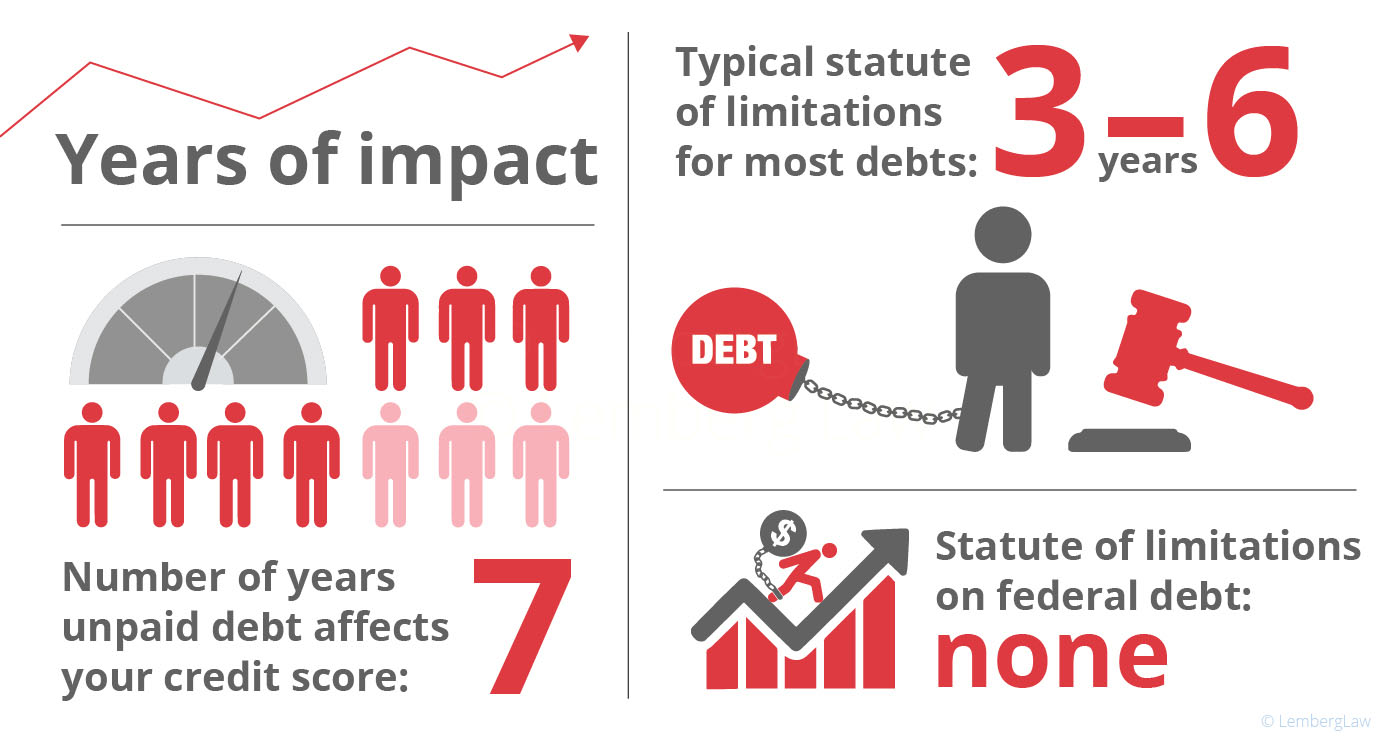

The statute of limitations applies to the filing of a lawsuit. Most fall between 3 and 6 years. Howard Law April 30 2021.

The state also provides an extra year three total for personal injury and injury to property claims if a motor vehicle is involved. Every state has its statute of limitations. The creditor cant file a valid lawsuit outside of the statute of limitations.

And activity can include making a payment creating a payment plan making a charge on the account accepting a debt settlement or. 13-80-101a will govern the statute of limitation for a breach of contract action. Its called the debt statute of limitations.

The statute of limitations on debt refers to the amount of time that a creditor can sue you if you have been in default. If they did not file it in a timely manner the case should be dismissed. A creditor may not successfully sue you beyond the time period provided in the statue of limitations.

Colorado Debt Statute of Limitations. If a debt passes the time limit the creditor can no longer file a lawsuit against the debtor. The statute of limitations for most Colorado debts is 6 years.

Here are the specific statute of limitations by state. What is the statute of limitations for lenders to pursue borrowers in Colorado who default on a home loan. ItвЂs called your debt statute of restrictions.

Of course you still owe the debt even after the statute of limitations has been reached. 6 rows This kind of debt collection has a statute of limitations of 6 years which can be renewed for. Re-setting the statute of limitations increases the amount of time you could be held legally liable for the old debt.

Colorados time limits for filing a civil action generally range from one to three years but rent and debt collection actions have a six-year limit. The statute of limitations refers to the time limit a creditor has to enforce a debt by way of a lawsuit. DonвЂt expect youll be sued right method.

This protects debtors from forever being exposed to liability for old debts. Unlike many states that set a variable time limit depending on. The statute of limitations is the limit of time the creditor had to file this lawsuit against you.

The statute of limitation in all states differentiates between oral and written contracts. Colorado Debt Statute of Limitations. Once this statute of limitations on debt collection period expires the debt collector andor creditor can no longer pursue the collection of the debt.

In Colorado debt collectors can sue you for an unpaid debt for up to six years after. For legal purposes debt is broken down into four categories. Statute of Limitations in Colorado and Older Debts.

The Statute of Limitations on Debt in Colorado Types of Debt. 1 The following actions shall be commenced within six years after. Statute of limitations on debt varies by state and limits the period of time a debt collection company can pursue collections.

In Colorado collectors can sue you for the unpaid financial obligation for as much as six years once you default about it. 51 rows Statutes of limitations are meant to put a time limit on creditors or debt collectors that may seek to take legal action to collect a debt. Most debts in Colorado have a statute of limitations of six years.

In many if not most situations Colo. An experienced bankruptcy lawyer can look into your case to determine whether the statute of limitations for the debt has run out or whether bankruptcy is the right path for you. No thats not correct.

This time period is not the same as the length of time a debt may stay on your credit report. That means that they cannot use legal remedies such as judgments liens and garnishments to collect from you if the statute of limitations has passed. A statute of limitations is the maximum time a debt collection agency or creditor is legally permitted to collect money from a debtor.

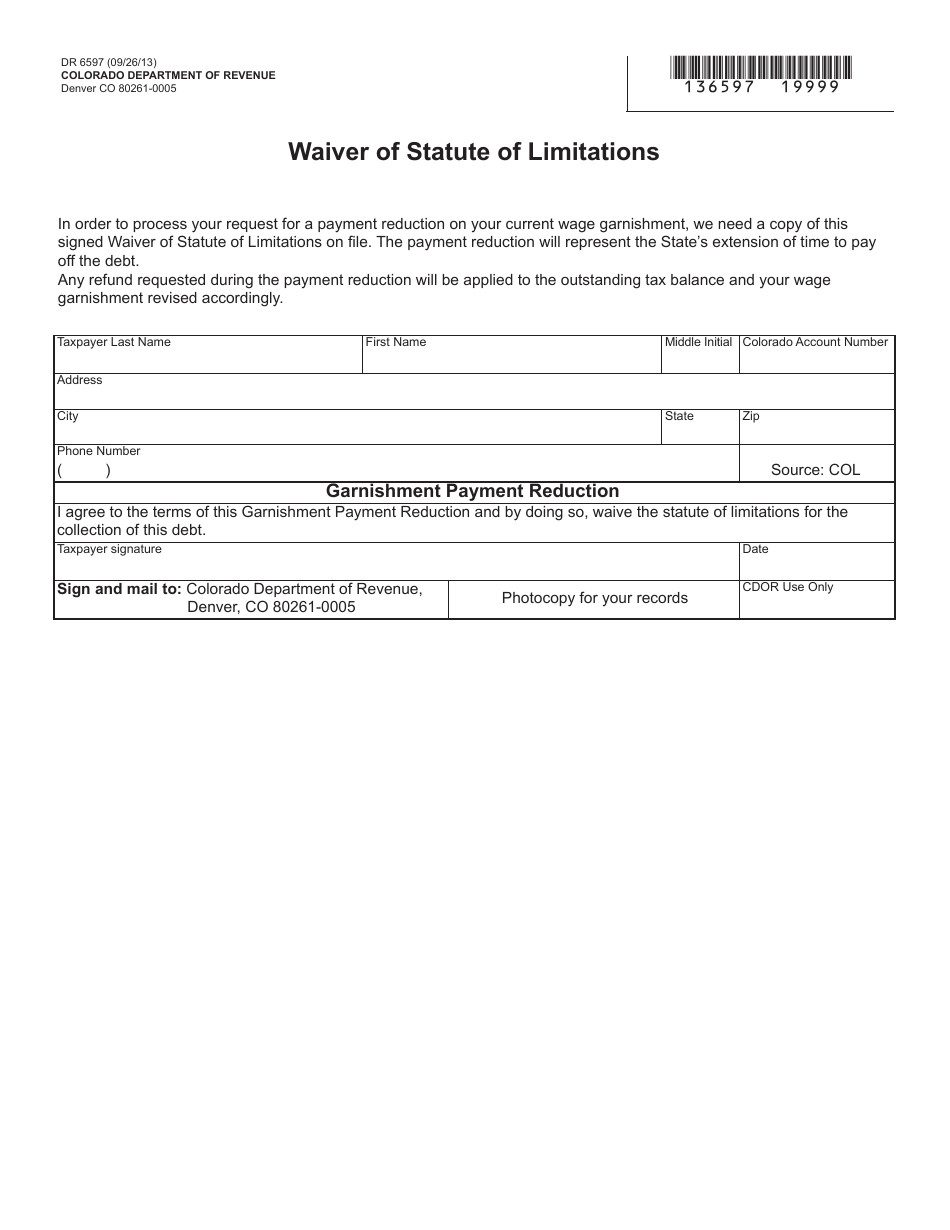

What Are the Civil Statutes of Limitation in Colorado. Colorado Revised Statute 13-80-1035 sets forth the following time limitations for the collection of a debt. You can re-set the statute of limitations on your medical debt to Day 1 if you decide to make a payment or even contact the debt collector.

The first is written contracts which. This is because Colorados statute of limitations on debt is six years. Colorado judgments may have a 6- or 20-year life.

Statute of Limitations in Colorado. Once the statute of limitations has been reached the creditor has no way to engage the legal system to get you to repay the debt. Each state puts restrictions on what long creditors can pursue financial obligation.

Some may go up to 20 years depending on the type of debt. The statute of limitations in the case of debt refers to how long the creditor or collector has to take legal action against you. The time period for the statute of limitation usually begins on the date of the last activity of the account.

New York Governor Signs Statute Of Limitations Bill Aca International

How Long Do Collections Stay On Your Credit Report

Understanding The Statute Of Limitations On Debt Collection Mmi

How Long Do Collections Stay On Your Credit Report

The Statute Of Limitations On Debt Everything You Need To Know

Debt Collection Laws Know Your Rights Lexington Law

Colorado Debt Statute Of Limitations Robinson Henry P C

Colorado Statute Of Limitations On Debt

Statute Of Limitations For Contract Debts

Irs Statute Of Limitations Colorado Tax Lawyers Help With Back Taxes

Colorado Statute Of Limitations On Debt

How To Permanently Stop Debt Collectors From Calling You

Colorado Debt Statute Of Limitations Robinson Henry P C

Statute Of Limitations In Colorado For Injury Claims Donaldson Law Llc

Colorado Debt Debt Collection Laws Statute Of Limitations Lendingtree

Statute Of Limitations On Private Student Loans State Guide Credible

Form Dr6597 Download Printable Pdf Or Fill Online Waiver Of Statute Of Limitations 2013 Templateroller